Air Force Says We Lose in War w/ China, Biden's Tax Plan vs. Islamic Wisdom Circa 1300, Immigrant Child Detention Centers at 732% Capacity, Feinstein Attempts to Ban 200+ Guns (The Five for 03/16/21)

Welcome to The Five.

Before we begin:

Despite my best efforts to avoid awards season (votes for awards are driven more by industry politics than quality or artistry), I did see the headline that Glen Close received both a Supporting Actress Oscar nomination and a Razzie nomination (satirical awards given to the worst movies) for the same role. She portrayed Mamaw, grandmother and sole parental figure to JD Vance in the true life Hillbilly Elegy. Entertainment Weekly points out that reviews were “unkind” to the film because “many critics took issue with the source author’s political views.” Speaking from experience, I’ve met enough costal elites working in media to be sure this is more a class issue than a political one. It’s not Vance’s (very moderate) conservative views that anger members of the media, it’s the humanizing of people in rust belt Ohio they’re pushing back against with the low Rotten Tomatoes score. Those of us between New York and LA are just supposed to shut up and buy tickets to Marvel movies, apparently. God forbid we might see some of our own stories on the big screen.

Best podcast episode I’ve listened to in March—Vance Crowe’s interview with Venture Capitalist Rick Holeton is a great look at why so many ex-cons return to prison, what that costs society and how helping the formerly incarcerated back into the job market is “an investment opportunity.”

Let’s get into the news:

[one]

Although no official statement has been issued, nearly every major news outlet is reporting the Biden Administration pushing for a tax hike.

President Joe Biden is planning the first major federal tax hike since 1993 to help pay for the long-term economic program designed as a follow-up to his pandemic-relief bill, according to people familiar with the matter.

Unlike the $1.9 trillion Covid-19 stimulus act, the next initiative, which is expected to be even bigger, won’t rely just on government debt as a funding source. While it’s been increasingly clear that tax hikes will be a component -- Treasury Secretary Janet Yellen has said at least part of the next bill will have to be paid for, and pointed to higher rates -- key advisers are now making preparations for a package of measures that could include an increase in both the corporate tax rate and the individual rate for high earners.

With each tax break and credit having its own lobbying constituency to back it, tinkering with rates is fraught with political risk. That helps explain why the tax hikes in Bill Clinton’s signature 1993 overhaul stand out from the modest modifications done since.

First off, I’m not going to engage in a knee-jerk hot take on a bill that hasn’t been proposed. But, a couple of early observations:

A). I agree that the government can’t keep printing money, so if the government is going to spend more, taxes should go up. If we had to pay from our own pockets each time the government overspent…government waste would get reigned in much more quickly.

B). When I was considering a government job, I turned to a mentor who has consulted with government organizations at a very high level. He told me 1/3 of people who work in the federal government are high intellect, high performers. And 1/3 are utterly incompetent morons who are the grown up equivalents to that kindergartner who ate play-dough. Since it’s nearly impossible to be fired from a federal job in under two years, most managers in the federal government would rather just let an employee do nothing than to grind for 24 months on making the case to terminate the low performing subordinate.

All government mismanagement of money comes down to people. And the bottom feeders in federal jobs are, anecdotally, roughly equal in number to the loyal public servants trying to do their best to serve the citizenry.

So, when we talk about government waste…the first conversation should be about how to fire bad employees faster from federal jobs.

C). I had no idea that individual tax credits all had lobbyists pushing them.

D). This graph from Bloomberg looks at government revenue since 1975. At first glance, I’m not able to draw any strong conclusions about tax rates vs. tax revenue (the money the government takes in).

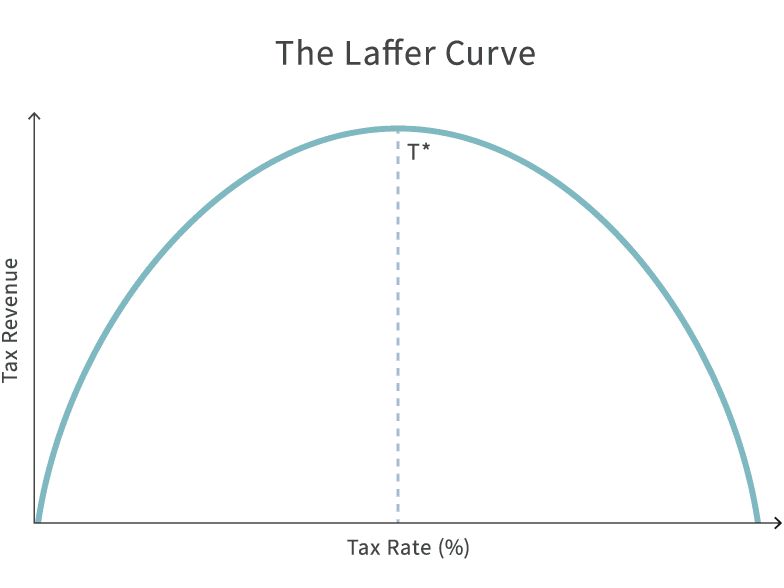

Taxes are a highly divisive issue, but in theory should be a simple topic to reach agreement upon. The Laffer curve dates back to the 1300’s Islamic history book The Muqaddimah.*

If taxes are too low, the government doesn’t collect enough to sustain necessary services. If taxes are too high, tax revenues fall because business growth is reduced, and, once again, the government doesn’t have enough money to sustain services.

Therefore, there should be a “perfect tax rate” that continues to grow the economy, raise wages and create jobs while also fully funding the government.

A good example of this is the Laffer Curve applied to Switzerland (8 million residents) and Sweden (10 million residents). The two European nations, with similar populations sizes, collect roughly the same amount of taxes per citizen. However, Switzerland does this at a lower tax rate, because business is growing faster than in Sweden.

Now, to be fair…the U.S. tax code is much more complicated than either nation, and I don’t know how to compare our system, which is heavily influenced by lobbyists (per the yahoo article).

I also don’t know how to scale up examples from smaller nations to a country with 330 million people.

However, if we look at a smaller scale, the “perfect tax rate” has been found in Iceland.

The government convened a special task force in 2005 to look into ways of transforming Iceland into a financial hub. Headed by Sigurdur Einarsson, chairman of Kaupthing, the country's biggest bank, the committee recommended in November that the corporate-tax rate be reduced to 10% from the current 18%. That's below the 12.5% in that other European economic powerhouse surrounded by water -- Ireland.

The benefits of low taxes are on full display in Iceland, which provides an almost perfect demonstration of the Laffer Curve. From 1991 to 2001, as the corporate-tax rate fell gradually to 18% from 45%, tax revenues tripled to 9.1 billion kronas ($134 million in today's exchange rate) from just above 3 billion kronas. Revenues have more than tripled again since 2001 to an estimated 33 billion kronas last year. Personal income-tax rates were cut gradually as well, to a flat rate of 22.75% this year from 33% in 1995. Meanwhile, the economy has averaged annual growth of about 4% over the past decade.

So, what’s the “perfect tax rate” for the U.S.? Is it Iceland’s 10% business tax? France’s 32%? Italy’s 27.8%?

I have no idea.

But I can guarantee that when the Biden tax plan hits the news cycle, the arguments are going to be about “who pays.”

The conversation should be “what’s the best rate to give the average person the best shot at getting richer.”

(Note: The Islamic Middle East led the world in scholarship for hundreds of years, which ended when Ghengis Khan’s Mongrel Hoard so utterly decimated the the subcontinent in 1323. Entire civilizations were quite literally wiped from history. More than 200 years after Khan’s death, a vacant city was found, with nothing left but charred ruins and Mongolian arrows still stuck in some buildings. We’ll never know who lived there, but Granddaddy Ghengis done killed them all, and wiped out an invaluable amount of history, science, math and technology in the process).

[two]

Conditions at a facility in Donna, TX where unaccompanied minors are picked up by U.S. Border Patrol have become unbearable (and likely illegal) as some sources site “capacity being at 732%” in the facility.

Hundreds of immigrant children and teenagers have been detained at a Border Patrol tent facility in packed conditions, with some sleeping on the floor because there aren’t enough mats, according to nonprofit lawyers who conduct oversight of immigrant detention centers.

The lawyers interviewed more than a dozen children Thursday in Donna, Texas, where the Border Patrol is holding more than 1,000 people. Some of the youths told the lawyers they had been at the facility for a week or longer, despite the agency’s three-day limit for detaining children. Many said they haven’t been allowed to phone their parents or other relatives who may be wondering where they are.

Despite concerns about the coronavirus, the children are kept so closely together that they can touch the person next to them, the lawyers said. Some have to wait five days or more to shower, and there isn’t always soap available, just shampoo, according to the lawyers.

President Joe Biden’s administration denied the lawyers access to the tent facility. During the administration of former President Donald Trump, attorney visits to Border Patrol stations revealed severe problems, including dozens of children held at one rural station without adequate food, water, or soap.

“It is pretty surprising that the administration talks about the importance of transparency and then won’t let the attorneys for children set eyes on where they’re staying,” said Leecia Welch of the National Center for Youth Law, one of the lawyers. “I find that very disappointing.”

Although none of the children reported situations as severe as during the Trump era, Welch said the lawyers “weren’t able to lay eyes on any of it to see for ourselves, so we’re just piecing together what they said.”

A 1997 court settlement known as the Flores agreement sets standards for government detention of immigrant children. Lawyers are entitled under Flores to conduct oversight of child detention. The Justice Department declined to comment Thursday on why the lawyers were denied access. The Biden administration has not responded to several requests from The Associated Press seeking access to the tent.

UPDATE: These allegedly leaked images were posted this morning (03/16) by Jack Posobic, a former Marine and documentary filmmaker. I would advise taking this info with a grain of salt, but at first glance they look valid to my untrained eye.

[three]

In the never ending partisan back-and-forth that is gun laws in the United States, California Senator Diane Feinstein has introduced a gun ban that would make 204 different firearms illegal.

Included in the bill is a provision to make bump stocks illegal, which are already illegal.

If you want to know how thouroughly this legislation has been researched and vetted, there you go.

The Department of Justice’s National Institute of Justice completed a comprehensive study on the 1994 assault weapons ban, which found no reduction in crime.

With tens of millions of new gun owners in 2020, it’s an odd play from a Geriatric Senator to run back a 90’s bill that’s got to be less popular with a Democratic base when women and minorities are becoming new gun owners at an unprecedented pace. I haven’t been able to verify this, but YouTuber Anita Okafor claims black women are the fastest growing demographic of first-time gun owners.

No word on whether or not Feinstein will become scuba certified to retrieve my guns after I took them all to sea the day of that tragic boating accident…

[four]

Well, this is a weird one. Fox News host Tucker Carlson criticized the Biden Administration in particular and U.S. military in general after President Biden announced “maternity flight suits” and updating women’s hairstyle requirements.

A Marine used an official Marines Twitter account to hit back at Carlson, which is a HUGE no-no for government account. A semi-tongue-in-cheek reply was issued from the official account:

Carlson replied on his show if you care to watch (full disclosure: I didn’t watch 100% of either clip).

Now, I tell you all that to say…it’s one of the top headlines in the country and has no real consequence.

While that squabble was happening, TWO INCREDIBLY IMPORTANT STORIES HAPPENED, AND HAVE BEEN LARGELY IGNORED.

A. A recent war game scenario run by the Air Force shows the United States would be crushed by China in full scale war.

B. The Army is considering relaxing the physical fitness requirements for female solders, as a larger number are failing the test. The Army’s first female officer, Capt. Krista Greist, "not only undermine their credibility, but also place those women, their teammates and the mission at risk."

The U.S. has been criticized for lagging behind other countries with using women in the military. That criticism usually leaves out an important piece of information…most nations use women in combat for specialized roles, including:

The Kurdish YPJ all female militia (pictured below) who are used to add psychological terror in the fight against ISIS, because ISIS fighters believe they cannot go to heaven if killed by a woman.

The Swedish LOTTA Corps, an all female reserve unit for defense to repel an invasion in the event that the main fighting force is out of the country.

Russia’s Female Spetznaz and all female airborne division, China’s all female special forces units which are designed to move in specialized situations where highly trained, deadly women can move throughout civilian populations and draw less attention than their male counterparts. (More on those units here).

Norway’s all female special forces unit, designed specifically to operate in the Middle East, where much of society is divided by gender.

On one hand, it’s understandable that as the world changes, the military will change with it. On the other, a country’s military exists for one purpose and one purpose only: kill the enemy and win wars.

As a nation, we can choose to relax the standards of who gets to go into combat, but I guarantee China isn’t doing the same.

[five]

If you are sick of me writing about cryptocurrencies, scroll down a bit for a cute Walrus story, and call it a day for this issue of The Five.

Bitcoin ATM’s are popping up rapidly all over the US, another sign that cryptocurrencies will soon become a part of daily commerce.

Fox Business Reports:

A new feature has appeared at smoke shops in Montana, gas stations in the Carolinas and delis in far-flung corners of New York City: a brightly-lit bitcoin ATM, where customers can buy or sell digital currency, and sometimes extract hard cash.

A new feature has appeared at smoke shops in Montana, gas stations in the Carolinas and delis in far-flung corners of New York City: a brightly-lit bitcoin ATM, where customers can buy or sell digital currency, and sometimes extract hard cash.

The reasons people use ATMs rather than transacting online vary. Some get paid in cash, some lack bank accounts, some want to send remittances abroad or want anonymity, while others feel more comfortable interacting with a physical machine.

Rebecca White, a 51-year-old bitcoin investor who lives in the Pittsburgh area, makes larger investments online and uses bitcoin ATMs when her family has extra money.

"When we do our grocery shopping and we have $60 left, I will stop at the bitcoin ATM," said White, who works in the nuclear power industry.

As of January, there were 28,185 bitcoin ATMs in the United States, according to howmanybitcoinatms.com, an independent research site. Roughly 10,000 came within the prior five months.

My advice?

A. Buy Bitcoin.

B. Forget about what you bought. Don’t touch it. Mass adoption is coming.

[epilogue]

Ireland’s first Walrus, which was spotted by a five year old girl in County Kerry on Sunday.

Scientists believe the Walrus, which weighs in at nearly 2,200 lbs when full grown, likely fell asleep on an iceberg and drifted south from Russia or Greenland. Scientists believe the lone Walrus will likely swim back to the Arctic circle after resting and regaining his strength during his stay on the Emerald Isle.

Until the next one,

-sth